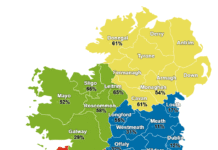

Applications for the Vacant Homes Grant stand at 11,000+. This is likely to rise to 20,000. Research from Hardware Association Ireland (HAI), would indicate that a further 20,000 units could be available by converting “above the shop” properties to residential – so together 40,000 homes. In mid-January and early February this year HAI undertook a survey to find out what incentives will encourage commercial property owners to convert their properties to homes.

Over the last few weeks this subject has attracted considerable media interest, reflecting the significance of rejuvenated buildings as a source of additional homes.

The report has been sent to all HAI members, TDs, County Councillors and Local Government officials throughout the country.

Recommendations

Expand Financial Incentives: Results from this survey are very clear that financial incentives are by far the most significant motivator to get the market moving and unleash its potential.

- Expand the number, the role and the responsibilities of vacant homes officers to include “above the shop” properties. While not a direct finding of this survey this change would be required to underpin any of the recommendations.

- Waiver on Capital Gains Tax (CGT) on “above the shop” properties. The strong support (93%) for a CGT waiver highlights the need for an immediate incentive to encourage property sales for redevelopment. This could significantly increase turnover and rejuvenation of vacant properties. According to the findings this will allow 20% + of vacant “above the shops” to be sold on to those who wish to rejuvenate them.

Give owners of above the shop properties a choice of incentives –

3a. Enhanced and Flexible Grant Structures: Extending the Vacant Home Grant to “above the shop” properties with the full amount per unit would address financial barriers and promote multi-unit conversions. Allowing a variety of ownership formats, including Limited Companies, to access these grants would further widen participation and investment.

3b. Tax Relief on Capital Expenditure: With 70% of respondents favouring tax breaks over grants, allowing property owners to offset renovation costs against rental income would create a powerful, long-term incentive.

4. Introduce a Graduated Vacant Property Tax: A punitive vacant property tax, increasing annually after a three-year grace period, would push property owners toward action – either through sale or development – while giving them a reasonable window to prepare. This grace period of three years would also facilitate the time required to prepare a database of such properties.